For asset operators and energy strategists, accurate forecasts are the backbone of profitability. But in volatile electricity markets, even the most advanced prediction models will be wrong some of the time. When that happens, how does it affect your operation?

At Front Analytics, we help energy leaders go beyond technical accuracy and explore the system-wide consequences of forecast error. Using system dynamics, we model how small inaccuracies can cascade into operational missteps, eroded trust, and growing financial exposure.

The Strategic Challenge

Battery and renewable portfolios increasingly rely on machine learning to predict real-time energy prices and make automated dispatch decisions. But these systems operate in highly dynamic, regulated, and uncertain markets — like ERCOT or CAISO — where volatility is the norm.

When forecasts miss the mark:

- Batteries are dispatched at the wrong time

- Arbitrage opportunities are missed

- Operational confidence in forecasting tools drops

- Losses accumulate before leadership realizes there’s a problem

Standard KPIs don’t capture this compounding effect. But system dynamics does.

A New Way to See Forecast Risk

We built a simulation model that visualizes how forecast accuracy — and confidence in those forecasts — shapes operational outcomes over time. It captures:

- Battery utilization and missed market opportunities

- Cumulative market exposure due to poor decisions

- Confidence dynamics: how trust in forecasting systems rises or falls based on recent results

- Feedback loops that reinforce risk if errors are ignored

It’s not just a model of the battery — it’s a model of your organization’s decision-making risk.

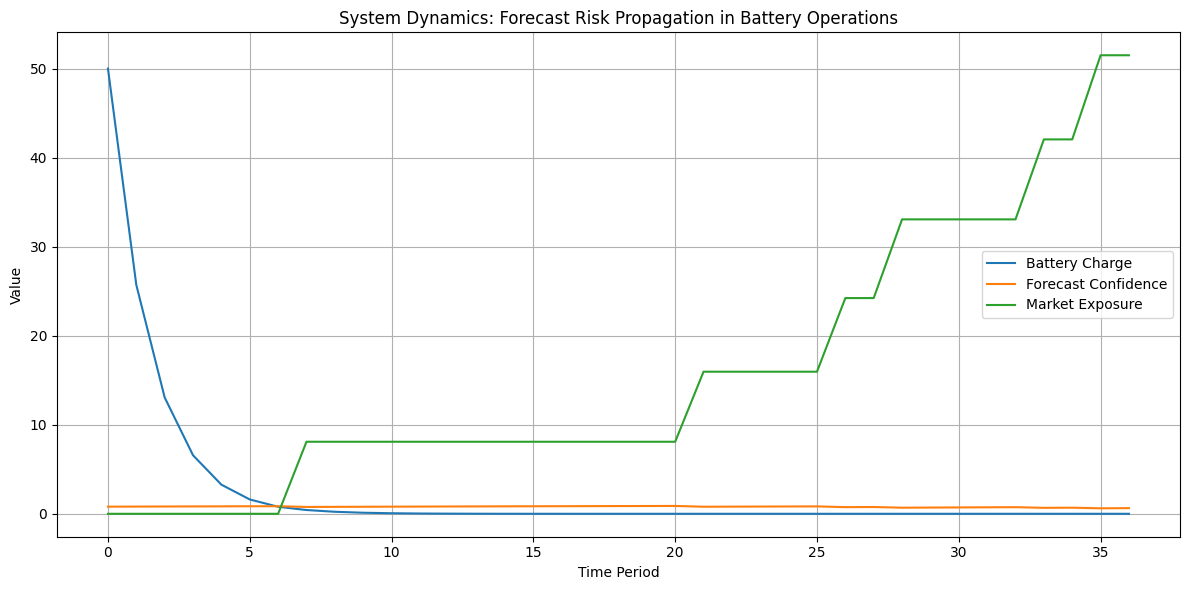

Simulating the Dynamics of Forecast Risk

We built a simplified system dynamics model to explore how forecast error influences battery operations over time. The simulation tracks three key variables:

- Battery Charge – energy available for dispatch

- Forecast Confidence – a dynamic measure of trust in the model’s predictions

- Market Exposure – accumulated operational risk or lost opportunity due to misaligned dispatch

The model reveals how even moderate forecast errors can trigger a cascade of compounding effects: reduced confidence leads to conservative or misinformed dispatch behavior, which increases exposure and constrains future flexibility.

This simulation can be extended to explore:

- Varying levels of forecast error and market volatility

- Confidence decay and recovery rates

- Dispatch strategies that adjust based on trust in forecasts

- Policy interventions such as retraining thresholds or override rules

- Economic outcomes like revenue loss vs. cost of mitigation

By adjusting parameters and testing scenarios, leaders can better understand how operational behavior, model performance, and market conditions interact to shape long-term resilience.

Key Takeaways for Leaders

Simulations show that:

- Delayed action amplifies exposure — by the time financial losses show up in reports, the underlying confidence erosion may already be systemic

- Overconfidence or underreaction can both be costly — operators may stick with a degraded forecast too long, or overcorrect after short-term volatility

- Better models aren’t the only answer — how you manage trust, policy, and operational flexibility matters just as much

The result: decisions that look rational in the moment can create unintended risk dynamics over weeks or months.

Why It Matters Now

As more operations shift toward automation, virtual power plants, and algorithmic trading, decision-makers must understand not just what the models are doing, but what happens when they’re wrong.

This model provides that lens — a structured way to test scenarios, evaluate risk posture, and guide strategy at the portfolio level.

Make Forecast Risk Actionable

We work with operators, strategists, and executives to tailor models to specific market conditions, pricing regimes, and policy frameworks. Whether you’re optimizing dispatch, evaluating AI investments, or preparing for volatility, this approach helps you see risk before it becomes loss.

Build resilience into your forecasting strategy. Make confident, informed decisions — even when the market doesn’t behave.