Why organizations need a new way to see, anticipate, and manage complex risk

In today’s environment, risk is no longer a single department’s problem — it’s a systemic concern that spans compliance, cybersecurity, operations, finance, and more.

Yet most organizations still treat risk as a set of point-in-time metrics or siloed indicators.

The result? Delayed responses, missed signals, and compounding vulnerabilities.

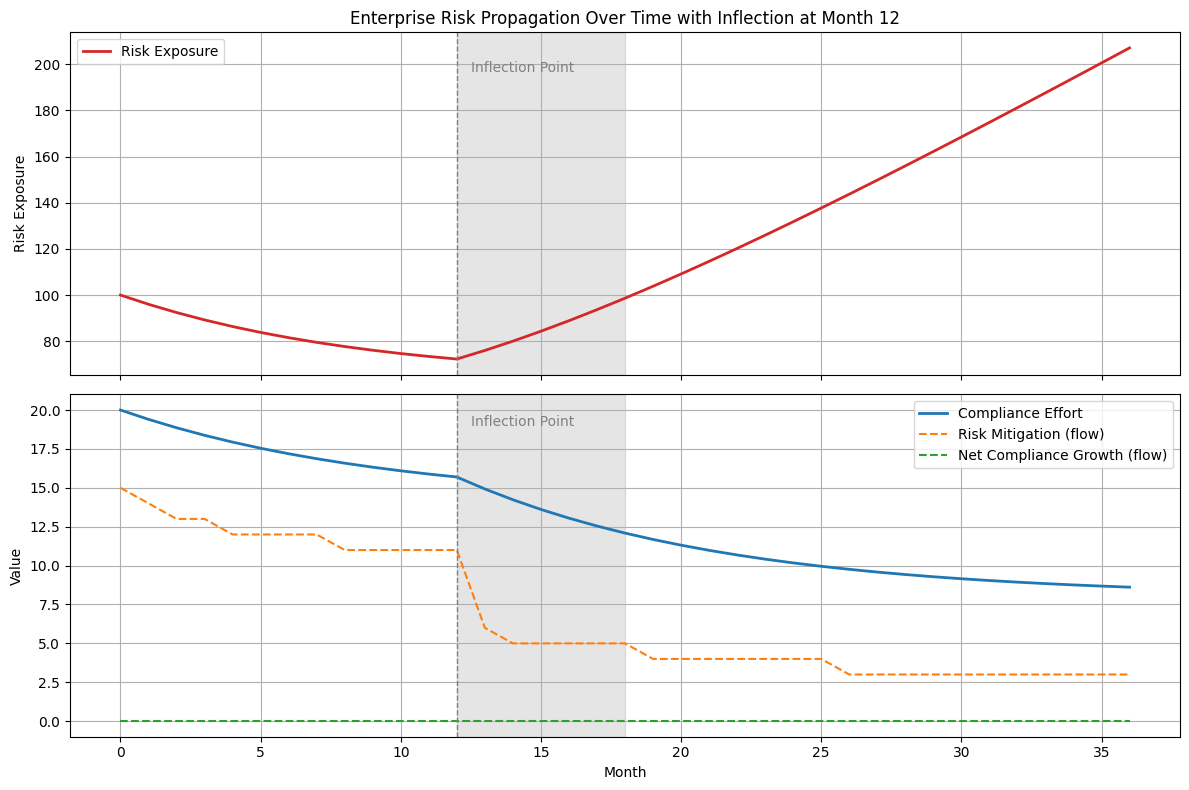

At Front Analytics, we help organizations model risk as a dynamic system — one with feedback loops, time delays, and interconnected consequences. Our system dynamics modeling framework gives leaders the foresight to act early, allocate resources wisely, and build true resilience.

The Challenge: Risk That Ripples

Risk doesn’t just rise and fall — it flows, amplifies, and rebounds. A compliance decision today might reduce incidents in six months… or create blind spots in nine. A budget cut might free short-term capital but expose the organization to outsized losses later.

Enterprise risk propagation is especially difficult to manage because:

- Causal chains are long and nonlinear

- Delays mask early warning signs

- Internal decisions influence external exposure

- Symptoms (e.g., incidents, losses) are visible only after the system has failed

Without a structured way to simulate these effects, leaders are forced to guess.

Our Approach: Modeling Risk as a System

We use system dynamics modeling to simulate how enterprise risk evolves over time. Our models include:

- Stocks: Risk exposure, compliance effort, organizational capacity

- Flows: Policy enforcement, threat levels, mitigation actions

- Feedback loops: How success leads to complacency, how underinvestment accelerates failure

- Delays: Between investment and impact, or between signal and consequence

By running simulations over months or years, we show how small shifts today produce large effects tomorrow — both positive and negative.

The Payoff: Smarter Risk Strategy

Modeling enterprise risk propagation delivers insights that can’t be found in dashboards or spreadsheets:

- Where and when to invest in compliance or monitoring

- Which policies accelerate mitigation and reduce exposure fastest

- How to avoid rebound effects from short-term success

- What long-term tradeoffs exist between cost, risk, and resilience

These insights inform strategy at the C-suite level — not just operational decisions, but capital planning, policy design, and organizational learning.

Who Benefits

This approach is valuable for any organization operating in a complex, risk-sensitive environment, including:

- Financial services

- Healthcare systems

- Technology and cloud infrastructure

- Energy and utilities

- Government and defense

- Supply chain–dependent enterprises

Why It Matters Now

Risk is no longer a static function. In an AI-driven, real-time world, leaders need tools that reflect how systems behave — not just how they appear.

System dynamics gives you that tool. It turns risk from something you monitor into something you can actively shape.

Let’s Model What Matters

If your organization is ready to move beyond static risk metrics and start managing the system beneath the symptoms, we’re here to help.

We tailor each model to your context and deliver results that guide real-world decisions.

Model smarter. Respond earlier. Lead with foresight. Schedule a Demo